Rental property tax depreciation calculator

Previously the cap was 15. Tax rates 2022-23 calculator.

Rental Property Calculator 2022 Casaplorer

You can see that 1092 is the common factor that can be used to calculate the annual value of all buildings while proceeding with calculating Greater Chennai Corporation property taxMultiply the annual rental value with 1092 to arrive at the annual value for any building.

. By convention most US. Super contribution caps 2021 - 2022 - 2023. Fixed Rate Investment Loans.

Certain property with a long production period. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate. So you dont need to have any tenants yet.

Taxes rental property investors need to pay. You didnt claim depreciation in prior years on a depreciable asset. Special depreciation rules apply to listed.

These properties might also qualify for a special depreciation allowance. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your income tax rate with a cap at 25. There are different ways to calculate the depreciation on a rental property which is why its a good idea to get help from a qualified tax pro if youre a landlord.

They were being depreciated with a useful life for. It may be a good investment. Depreciation recapture tax rates.

You should claim catch-up depreciation on this years return. Fortunately there are several ways to minimize and even avoid paying tax when you sell a rental property. Reasonable travel allowance rates.

Read more about rental property depreciation before writing it off and use our rental property depreciation calculator to make your life easier. Top Six Property Negotiation Tips For Home. Catch-up depreciation is an adjustment to correct improper depreciation.

Reduce your tax with a depreciation schedule. BMT Tax Depreciation works with your accountant to ensure that your depreciation claim for your investment property is maximised each financial year. The NMC also offers an online property tax calculator using which you can calculate your property tax real time.

Make major management decisions such as choosing rental property managers approving new tenants setting rental terms and approving improvements For example if you actively participated in the rental and have a MAGI of 95000 with a rental loss for the year of 21000 you can deduct your entire rental loss from your active activity income. All about Kerala building tax online payment. HECSHELP loan repayment rates.

The IRS taxes the profit you made selling your rental property 2 different ways. Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. Your depreciation recapture tax rate will break down like this.

Qualified GO Zone property placed in service before Dec. Depreciation rules for listed property. Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years.

Her property tax was based on assessed values of 10000 for the land and 25000 for the house. But what about the other assets. Follow these 8 tips to increase your chances of successful rental property investment.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Rental Property Depreciation deductions limited to new. There are also special.

For your investment property tax you can provide your accountant with all of your documents and let them take care of it for you. The calculations are as follows. Depreciation commences as soon as the property is placed in service or available to use as a rental.

Be aware that you cannot claim a deduction against your rental property for the cost of preparing your personal tax return. In tax terms this is known as depreciation which is tax-deductible. Qualified Liberty Zone property placed in service before Jan.

This 25 cap was instituted in 2013. Although your rental property sold for 164000 you were able to reduce the net sales. Tax Deductions for Depreciation.

I inherited a rental property that was being depreciated. This cover the 20 tax deduction for landlords. Fees or commission paid to agents who collect rent find tenants and maintain your rental are tax.

Annual property tax Plinth area x Monthly rental value per sq ft x 12 x 017 030 depending on MRV and based on slab rate of taxation 10 per cent depreciation 8 per cent library cess. Tax rates 2021-22 calculator. So the property you want to invest in earns a gross rental yield of 324 which is slightly higher than the property you currently own.

Property depreciation for real estate related to. Your property and the contents of that property are naturally going to depreciate over time. Now we are armed with the two components of the formula and we can plug these numbers directly into the formula to calculate gross rental yield.

Assuming you are in the 24 tax bracket your depreciation recapture tax due would be 15654 x 24 3757 rounded. Repairs Maintenance. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation.

Depreciation can be claimed as a tax-deductible expense from the moment you purchase the property. When you sell a rental property you need to pay tax on the profit or gain that you realize. Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property.

Residential rental property is depreciated at a rate of 3636 each. Real estate investors can defer paying capital gains taxes using Section 1031 of the tax code which lets them sell a rental property while purchasing a like-kind property and pay taxes only after. I believe I must start depreciating the property itself for 275 years SL using the net FMV of the building at the date I inherited it as the basis.

That 709 form is not too hard to do by hand in this case. The deduction to recover the cost of your rental propertydepreciationis taken over a prescribed number of years and is discussed in chapter 2. However you can submit this as a write off when doing your own income statement for the year.

Yes you should claim depreciation on rental property. I understand that as donor my mother needs to file form 709 and pays zero tax because of the 545M gift limit. My mother also claimed depreciation on the rental property during the years under her ownership.

It and its new floor coverings and appliances have been depreciated for 2 tax years. It is very necessary to know about the rental property tax deduction for a landlord so that tax can be paid on time. If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days.

Before changing it to rental property Eileen added several improvements to the house.

Rental Property Depreciation Rules Schedule Recapture

Macrs Depreciation Calculator Irs Publication 946

Free Macrs Depreciation Calculator For Excel

Rental Property Cash On Cash Return Calculator Invest Four More

Rental Property Depreciation Rules Schedule Recapture

Rental Yield Calculator

Renting My House While Living Abroad Us And Expat Taxes

Lzbw6a1vckffem

Depreciation Schedule Formula And Calculator Excel Template

How To Prepare A Rental Form T776 In 10 Easy Steps Madan Ca

Straight Line Depreciation Calculator And Definition Retipster

8 Powerful Real Estate Investment Calculators A Full Review

Investing Rental Property Calculator Determines Cash Flow Statement Real Estate Investing Rental Property Real Estate Investing Rental Property Management

Depreciation For Rental Property How To Calculate

Straight Line Depreciation Calculator And Definition Retipster

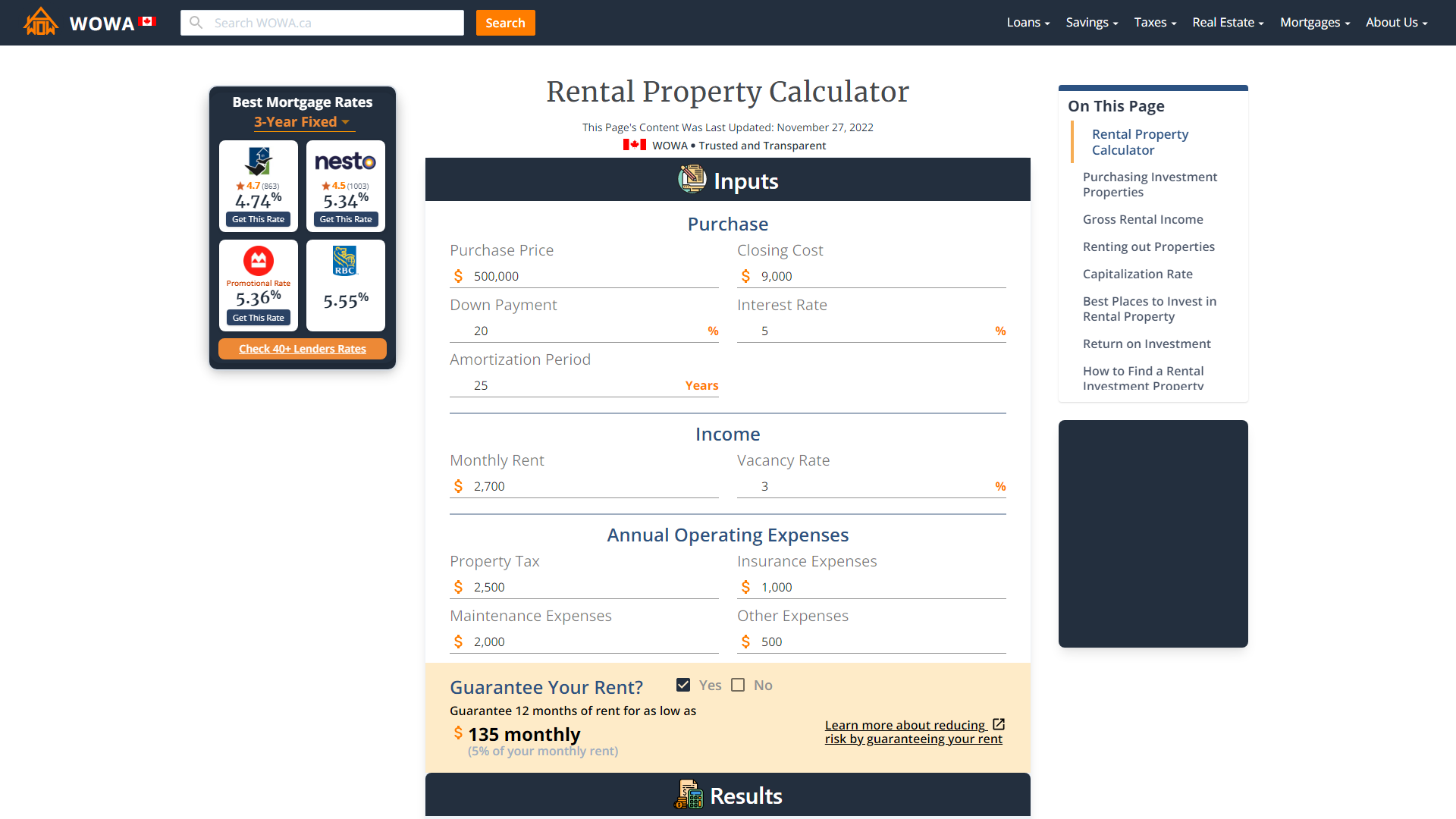

Rental Property Calculator Most Accurate Forecast

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com